Overview:

In today’s generation people it is not uncommon for them to encounter financial hits which force them to take a loan option. It is not a guaranteed statement that whenever you go to take a loan, your application will be accepted. Especially in that situation when the score of your credit card is below then the criteria.

And here comes the no-credit-check loans that come into action. This will allow borrowers to take the loan without checking the behavior of their credit card. There are a few different types of no-credit-check loans that are available, and in this article, we plan to discuss them.

In this article, we will discuss the types of no-credit-check loans, and the pros and cons of no-credit-check loans. And the most beneficial thing about how to choose a suitable lender which is according to your needs. And which understands your needs.

Analyzing the Different Types of No Credit Check Loans:

No credit check loans come with a complete series, and they have their advantages and disadvantages. Which range from payday loans to personal and title loans.

Let’s take a look at all of them.

Payday loans are defined as they are common or short-term loans that take care of emergency expenses. On the other hand, personal loans are taken for multiple purposes, and these are long-term loans.

However, the third type of loan is a Title loan which allows you to use your assets as a deposit for loans. The process of analyzing no-credit-check loans is confusing, and they require proper acknowledgment. It is difficult to comprehend terms and fees around the type of loan ancient to initiate a decision.

Although, there are no credit check loans that can partner up and play an important role in specific scenarios. We highly recommend you to option for the respective in difficult necessity.

Pros and Cons of No Credit Check Loans:

No credit check loans are personified as the ideal solution for people who are struggling with their financial situation. Along with their poor credit scores and no credit history. It does not force the borrower for any kind of deposit when it comes to issuing the loan.

Another attractive virtue of the respective is that it finishes the middleman and engages the needy person with direct lenders. This will assure a rapid and safe process.

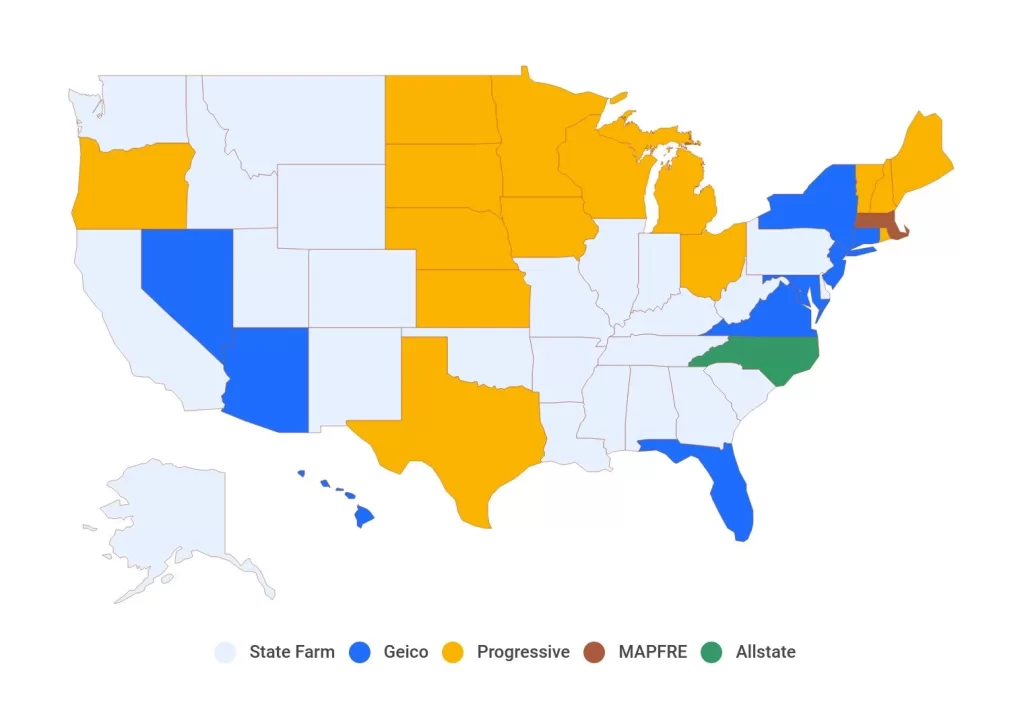

If we analyze the cons of no credit check loans, then it has high interest rates and constrained loan repayment options. Which are profound nominees. However, this loan is unavailable in different states, which is also a disadvantage of it.

According to CFBP (Consumer Financial Protection Bureau, the APR of payday loans is an average of 400%. Plus, the borrower also pays some other fees, which include: organization fees, non-sufficient fund fees, and late fees.

Benefits of a Personal Loan with No Credit Check:

A personal loan along with no credit check is like a spicy dish for you of both worlds. By supposing such a loan, you will be credited the required amount the acknowledging your score on your current credit card.

Thanks to the above statement, you will enjoy flexibility, freedom, and great repayment terms like a bonus. The main focal point is personal loan along with no credit check loan that comes in handy. And allow one person to navigate financial difficulties.

Applying for a Loan with Poor or Non-Existent Credit History:

We agree that applying for a loan can be a painful and stupid experience, specifically if you uphold a credit history that is below par. It is completely alright to sense a feeling that your financial past is avoiding you from accomplishing your goals or restraining you from what you need.

Although it is important to keep in mind that you are not alone in this try, multiple cases demonstrate with a little extra diligence that you can come out successful. You can still find a suitable lending option that marks all the checkboxes according to your needs.

Research and don’t doubt to ask questions no matter if it is from the credit union or an online lender, and take attention to every option. Plus, securing funds from a poor credit history can take the shape of a decent credit score in the upcoming future.

Choosing the Right Lender for Your Needs:

Choosing the right lender that is totally according to your needs is not a cakewalk or easy, but it requires extra effort. You need to pocket a great loan that is suitable for your requirements. We highly recommend that before creating any dealings, it is beneficial for taking specific factors into account like fees, long terms, interest rates, and customer service ratings.

The people who are known as seek lenders who offer you competitive rates along with platters transparency when we talk about pricing. The other helpful resources, convenient communication, and accessibility is also a checkbox that didn’t forget to get marked. When you do your chores religiously, then you will feel very grateful and blessed that you have chosen the right option according to your financial conditions.

Bonus Tips to Help You Choose a Reputable No Credit Check Lender:

It will be tempting when you turn on a no-credit checker lender when you know that you need to borrow money. These lenders will frequently advertise fast and easy approval regardless of your credit card score.

Although not all the no-credit-check lenders are made equally, some may have predatory practices which can leave you as bad as ever before. So, if you want to protect yourself, then choose a lender which has reputable.

You need to look for transparent lenders related to their interest rates and fees. Keep in mind that read the fine print before signing on any kind of paper. In addition, you need to consider reaching out to your non-profit organization and local credit card union to get guidance on finding a trustworthy lender. With little research and careful decisions, you can save your funds without falling victim to the predatory loan.

Conclusion:

No credit check loans can be a great solution for those people who are facing financial difficulties and have poor credit scores or no credit history. Although, it is beneficial to understand the different types of loans, their pros and cons, and to choose a reputable lender that is according to your needs.

The process of applying for a loan can be overwhelming, but with proper research, diligence, and asking the right questions, it is possible to find a suitable lending option that fits your financial circumstances. Remember to read the fine print and consider reaching out to non-profit organizations or local credit unions for guidance. By doing so, you can avoid falling victim to predatory loans and secure your financial future.